Mortgage Houses For Sale In Ghana [Our Top Picks]

Are you looking for Ghana home loan houses for sale? or mortgage houses for sale in Ghana?

At the end of this article, you will know all the mortgage houses for sale in Ghana and its regions, be it Accra, Kumasi, Tema, or other popular towns and regions.

Mortgages Houses For Sale In Ghana: One of the ways to raise funds for your commercial or residential projects is through mortgages.

When you buy a house without having all the money in cash, you tend to rely on the mortgage.

In Ghana, many financial institutions will help you acquire your dream home by helping you settle the payment through a mortgage.

Also, most of the real estate in Ghana allows you to acquire property through a mortgage.

But what is a mortgage in Ghana? How can you buy a house through a mortgage?

Are there mortgaged houses for sale in Ghana that you can buy?

This article will cover all these questions, so let’s dive right in without wasting much time.

What Is A Mortgage In Ghana?

A mortgage is a loan payable over an extended period, and the money can be used for various purposes, including home improvements or funding property purchases.

How Does Mortgage Work?

Here is how a mortgage works: a businessman or individual uses a mortgage to buy a house in real estate or buys real estate without the need to settle the entire purchase price.

The buyer will then repay it in a loan form with interest within a specified time frame.

The buyer will then access the real estate while still making payment.

Banks That Give Mortgages In Ghana

Some banks give mortgage loans in Ghana, and these banks are:

- Fidelity Bank

- UBA Africa

- Bond Financial Services

- Omni Bank

- Stanbic Bank

- Dalex Financing

- Societe Generale Ghana

- First National Bank

- Republic Bank

Each bank comes with its terms and conditions, and also, in Ghana, every mortgage provider has its interest rates.

Mortgage Process In Ghana

Here is the mortgage process in Ghana:

- The borrower will search for their preferred real estate and make negotiations with them.

- The borrower will then contact one of the mortgage lenders.

- The lender will request evidence to be sure the person borrowing can be able to pay the loan.

- After approval, the bank or the lender will then give the lender the amount with its interest.

- Some banks make payments to the real estate directly, and you don’t have to do anything. All you have to do is sign the agreement form and let the bank handle the rest.

- You will then move in and start paying the bank on how you choose to make the payment when signing the agreement form.

Types Of Mortgages In Ghana

There are 4 types of mortgages in Ghana, each of which comes with its terms and conditions. Here are the four types of mortgages in Ghana:

Fixed-Rate Mortgages

With this mortgage, the interest rate does not increase throughout the loan. You will still be paying the agreed interest rate amount even after years.

Adjustable-Rate Mortgage

With the adjustable-rate mortgage, the interest rate is not fixed entirely but is fixed for a certain time frame.

For example, the interest rate will be the same for five years, and then there will be a little increment after the five years if the loan is not settled.

Interest-Only Loans

These are the types of mortgages in that the borrower is asked to pay only the interest on the loans within a certain period.

After paying the interest, the borrower will have some time to pay the principal in a subsequent form.

Reverse Mortgages

A reverse mortgage involves a homeowner above 62 borrowing against the value of their home. The borrower will then receive funds as a lump sum.

Mortgage Loan Interest Rate In Ghana

Mortgage rates in Ghana depend on the type of mortgage you want, either fixed or adjustable, and the years you are willing to use to settle your loan.

The normal interest rate for all banks is between 3% – 11% if you intend to settle the payment within 10 years, but you will have to pay between 5% – 21% interest if you intend to settle the payment within 20 years.

Now that you know more about mortgages in Ghana let us cover houses or real estate so that you can buy their houses through a mortgage.

Mortgages Houses For Sale In Ghana

Here are the available mortgage houses that you can buy in Ghana. The list you are about to read is the most trustworthy and popular real estate agencies partnered with top banks providing mortgages in Ghana.

Adom City Estate

Adom City Estate stands as a beacon of luxury in the heart of Accra, Ghana, offering a distinctive high-rise residential experience.

This exclusive development features two towers, boasting a total of 52 modern and vibrant apartments meticulously designed to exceed the highest standards of comfort and opulence.

One of the hallmark features of the estate is the expansive and well-planned layout, set on spacious land to provide residents with a delightful living experience.

The architecture of the buildings reflects a commitment to creating a luxurious and aesthetically pleasing environment.

Security and attention to detail are paramount at Adom City Estate, ensuring that residents enjoy not only the epitome of comfort but also a secure and tranquil lifestyle.

The development has been thoughtfully designed to offer a haven where every detail contributes to a safe and pleasant living experience.

For those aspiring to make Adom City Estate their home, the houses are available within a price range starting at GHS 605,789.

This pricing structure caters to discerning individuals seeking a residence that combines luxury, comfort, and a serene living environment.

Adom City Estate emerges as a premier choice for those desiring a sophisticated and secure residential experience in Accra, Ghana.

Adom City Estate House Prices

Below are some of their available houses for sale at Adom City Estate:

| Location Of Land | Price |

| Kasoa | GHS 50,000 |

| 2Bedroom Semi-Detached – Phase 5A Tema | GHS 51,000 |

| Adom City – B Greater Accra Region | GHS 220,000 |

| Phase 1A Tema Ningo Prampram District | GHS 170,000 |

Adom City Mortgage Partners

One thing that makes Adom Real Estate stand out is that they work with many banks in Ghana and allow you to buy their houses through a mortgage.

Below are the banks Adom City has partnered with:

- Absa Bank

- First National Bank

- Ghana Commercial Bank

- Prudential Bank

The Paradise Estate

The distinguished Paradise Estate, a creation of Swami India Ghana, stands as a testament to the company’s prominence in crafting some of the most exquisite real estate and architectural marvels in Ghana.

With a substantial presence in the Ghanaian real estate scene for an extended period, Swami India Ghana has earned a reputation for excellence.

One of the distinctive features that attract buyers to the Paradise Estate is the company’s commitment to facilitating seamless payments through mortgage options.

Recognizing the significance of home financing, Swami India Ghana offers a user-friendly and flexible payment structure, providing buyers with ample time to settle their payments comfortably.

The allure of Paradise Estate extends beyond its architectural brilliance, encompassing a buyer-centric approach that prioritizes financial ease and convenience.

The flexible payment rules contribute to a stress-free purchasing experience, ensuring that buyers can navigate the financial aspects of homeownership with confidence.

For those considering Paradise Estate as their residence, the house prices span from GHS 864,654 to GHS 1,985,700.

This pricing range reflects the commitment of Swami India Ghana to offering a spectrum of options that cater to diverse preferences, making Paradise Estate an attractive choice for individuals seeking a harmonious blend of luxury, architectural beauty, and financial convenience in their home purchases.

Paradise Estate Mortgage Partners

- First National Bank

- Republic Bank

- Absa Bank

- Stanbic Bank

Paradise Estate House Prices

| Units | Price In Cedis |

| Type A House | GHS 2,301,459 |

| Type B House | GHS 1,669,452 |

| Type D House | GHS 1,271,964 |

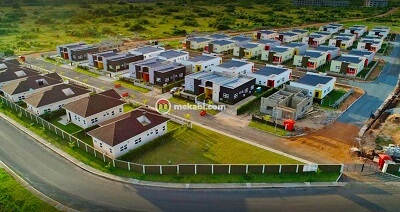

Appolonia City (The Oxford)

Appolonia City Estate stands as a testament to excellence in the Ghanaian real estate landscape, boasting first-class buildings that have made a significant impact over the years.

Serving Ghana with distinction, this estate has become synonymous with quality and sophistication.

Within the expansive grounds of Appolonia City Estate, a diverse range of quality homes awaits prospective residents.

The offerings include meticulously crafted apartments and duplexes, each reflecting a commitment to top-notch design and construction.

The estate takes pride in delivering residences that not only meet but exceed the highest standards of living.

Appolonia City Estate recognizes the diverse needs of its potential residents, and as such, offers a variety of property options.

Among these are one and two-bedroom properties, providing flexible choices for singles or couples with children.

This thoughtful mix of housing options caters to different lifestyles, ensuring that individuals and families can find the perfect home that aligns with their preferences and needs.

Whether one seeks the intimacy of a one-bedroom residence or the additional space provided by a two-bedroom property, Appolonia City Estate strives to create a living environment that resonates with comfort, style, and practicality.

It stands as a symbol of refined living in Ghana, offering a range of quality homes to suit the diverse tastes and requirements of its esteemed residents.

Types Of Homes You Can Buy At Appolonia City

There are three types of homes in Appolonia City, and they are:

The Walton – 2 or 3 bedrooms

The Walton Features:

- Air-condition & Water Heater Preparation

- En-suite Master Bedrooms

- Kitchen with Pantry Area

- Kitchen Cabinets with Quartz Worktop

- Plasterboard Ceilings

- UPVC Casement Glass Windows

- Visitor’s Washroom

- Panic Alarm System

- Contemporary Hidden Roof Design

The Eaton

The Eaton Features:

- Kitchen Cabinets with Quartz Worktop

- Air-condition & Water Heater Preparation

- Visitor’s Washroom

- Plasterboard Ceilings

- En-suite Master Bedroom

- UPVC Casement Glass Windows

- Contemporary Hidden Roof Design

- Panic Alarm System

- Kitchen with Pantry Area

The Barton

The Barton Features:

- En-suite Master Bedroom

- Kitchen with Pantry Area

- Air-conditioning Units in all rooms

- Kitchen Cabinets with Quartz Worktop

- Visitor’s Washroom

- Plasterboard Ceiling

- UPVC Casement Glass Windows

- Panic Alarm System

- Contemporary Hidden Roof Design

Houses at Appolonia city range from GHS 596,448 to GHS 1,153,656. Let us check the prices out.

Appolonia City House Prices And Location

| Units | Price In Cedis |

| The Walton | GHS 596,448 – GHS 659,232 |

| The Eaton | GHS 753,408 |

| The Bartons | GHS 1,153,656 |

Appolonia City Mortgage Partners

Appolonia city estate works with the best banks that offer home loans. These banks in Ghana are:

- Ecobank

- HFC

- Stanbic Bank

How Appolonia City Mortgage Payments Are made

Appolonia City allows you to make payments through a mortgage within 6, 12, or 18 months.

The number of payments you will make depends on the timeframe you have chosen to settle the payments.

Here Are Their Payment Plans

| When You Choose To Pay In 6 Months | When You Choose To Pay In 12 Months | When You Choose To Pay In 18 Months |

| 40% | 20% | 20% |

| 40% | 40% | 15% |

| 20% | 40% | 15% |

| 15% | ||

| 20% |

Real Estate With Flexible Payment Plans

Homes are becoming expensive daily, and these real estate agencies know about that.

Because of this, many of them allow you to pay through mortgages, and above all, they also have flexible payments.

Now we will cover real estate with flexible payment plans so that it will be easy for you to acquire your dream home.

Ayi Mensah Park

Ayi Mensah Park is known for its awesome building designs. The company has houses across Ghana and is known to be the best real estate company that offers flexible payment.

Ayi Mensah Park Payment Plans

Below are their payment options

| Purchase date | Standard Plan | Alt. Plan | Plan 2 |

| 3 months | n/a | Payment 2: 30% | Payment 3: 25% |

| 5 months | Payment 2: 20% | n/a | n/a |

| 8 months | n/a | Payment 2: 20% | Payment 3: 25% |

| Pre-delivery inspection | Payment 3: 30% | Payment 4: 20% | Payment 4: 25% |

| Upgrades & additional charges | Final delivery | Final delivery | Final delivery |

Trasacco Estates

Trasacco estate houses some of the country’s wealthiest figures because of its awesome designs and environments.

The estate is quite expensive, but if you have been searching for houses for sale in Accra, Ghana, and want to live in a place with many celebrities and public figures, then you can design to get yourself a house in this real estate.

They also have a flexible payment plan. Here is the payment plan for the Trasacco estate.

Trasacco Estates Payment Plans

| Payment Date | Amount (Cedis)/Percentage |

| Initial deposit | GHS 70,00 |

| Every 3 months | Pay 25% |

| Upon completion | Pay remaining balance |

Lakeside Estate

Lakeside is known for building affordable houses, and because of this, they also make it easy for buyers to buy their houses.

Lakeside Estate Payment Plans

| Status | Amount/Percentage | progress |

| One-time purchase | 100% | completed |

| Initial Deposit | Pay 50% | Starter home |

| Second payment | Pay 40% | Roofing level |

| Final payment | Pay 10% | Handover |

Frequently Asked Questions

The price of a house in Ghana ranges from GHS 1,454,241 to GHS 14,000,000. The price of the house depends on the location, type of house, and mode of payment.

Conclusion

Now it’s easy to buy a house without having the full cash. You can easily buy your dream house through a mortgage and then pay later while living in the house.

In this article, we covered mortgages and houses for sale. Before covering that, we dived into the meaning of mortgages in Ghana, and the types of mortgages, and then also covered real estate that offers flexible payment methods in Ghana.

For more house prices, you can read our guides on HFC house prices, Adom houses, and Adom land prices.

You can also check out real estate companies in Ghana and real estate companies in Kasoa if you want to reside in Kasoa.